Our Impact

$13.8 Million

deployed

2,105

small businesses assisted with loans and technical assistance across D.C., Maryland, and Virginia

1,600

quality jobs created or retained

64%

low-to-moderate income individuals served

Since 2019, the Entrepreneurs of Color Fund has worked with a wide range of small businesses across the Washington, D.C. Metropolitan Region. These businesses are supporting generational wealth building while also enhancing the vitality of their communities and creating jobs that help drive the local economy. Here are a few of their stories.

deployed

small businesses assisted with loans and technical assistance across D.C., Maryland, and Virginia

quality jobs created or retained

low-to-moderate income individuals served

"As a second-generation immigrant, leaving a legacy for my family was a top priority. I realized I could do more for my community by becoming a consultant."

Yashieka Anglin, MBA, is the CEO of Anglin Consulting Group, an 8(a), SDVOSB, WOSB, and HUBZone certified strategic business consulting firm. She brings more than a decade of experience in business expansion, financial management, sales, marketing, and IT systems planning and implementation.

A lack of access to credit, a factor that disproportionately affects Black women-owned businesses, nearly brought Yashieka to a standstill. When Yashieka approached Wacif in 2018, ACG successfully applied for a $50,000 line of credit. Since then, ACG has received multiple loans from Wacif, including a loan through the Entrepreneurs of Color Fund that helped fund costs associated with hiring three new staff members. Yashieka, a US Air Force veteran, resides in D.C. with her two daughters.

Supported by

Genell Anderson is the managing member of AMAR Group LLC, an architecture, construction, and design company servicing residential and commercial projects throughout the Washington, D.C. metropolitan area. In 2006, AMAR Group received the Mayor’s Award for Excellence in Historic Preservation and was also featured on the Emmy-award-winning home improvement television show This Old House for the renovation of a 130-year-old classic row house in D.C.’s Shaw neighborhood. Genell’s loan from Wacif through the Entrepreneurs of Color Fund has allowed her to add and retain six staff members and make purchases in order to successfully execute new design and architectural contracts.

Supported by

"Having someone like Wacif on my side gives hope during a hopeless time in history."

"It was a real struggle for us to find banking partners who would support us. LEDC showed us there were other people who believed in us besides our customers."

Yi Wah is the founder and co-owner of Number 1 Sons. He opened the business in 2012 in hopes of sharing the foods he knows and loves. His business grew and soon Wah was selling fermented and pickled products at over 30 farmers markets throughout Washington, D.C. However, COVID-19 put the business in jeopardy.

After unfruitful meetings with area banks, Number 1 Sons was introduced to LEDC. The loan they received enabled Number 1 Sons to invest in refrigerated vans and pivot to safely deliver their products to 20,000 houses and counting. They also partnered with small local farms to help them get their products to households across the region by acting as a delivery service. They also made it a priority to hire unemployed restaurant workers. To date, they have worked with over 40 small farmers and makers who might otherwise have been disproportionately impacted by the pandemic.

Supported by

Entrepreneur of Color Fund recipient Jessica Swift offers catering, at-home meal delivery, and nutrition consultations in Greater Washington through her small business Sauce. With a team of registered dietitians and chefs, Sauce remains committed to the mission laid out nearly a decade ago: Make healthy food taste good.

Sauce used the EOCF to refinance a loan and build out a commercial kitchen space for the team. The onset of the pandemic, however, forced Jess adapt her business model, while prolonging the construction project of the new commercial kitchen space. Jess and her team have been operating through the night at Union Kitchen preparing meals for clients and donating hunderds of meals to essential, frontline workers combating COVID-19 and families in need. Sauce also launched a GoFundMe campaign to increase donations towards her free-meal initiatives.

To ensure that staff remain safe, Sauce has implemented safety measure such as social distancing, wearing gloves and masks, and practicing temperature checks. To accommodate the late night/early morning travel, Jess covers her staff’s transportation costs, ensuring a safe commute.

Supported by

"I always try to bring in local people that care about food. When you hire people in your community, it’s more important to them. They want to see the people in their community do better, too."

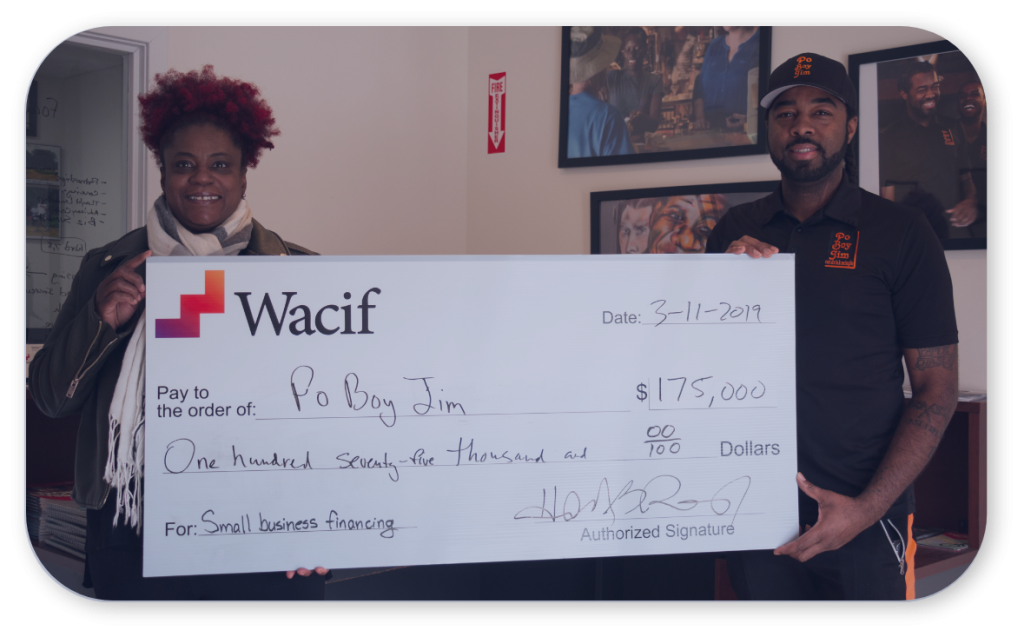

"Wacif came in and paid that debt off and drastically reduced my monthly payments. Now it’s easy to make that repayment."

Ngina Thomas is a Master Stylist and Certified Hair Loss Practitioner with over 25 years of experience. In 2012, she founded Studio Chique, a full-service hair salon and specialty spa.

To help finance renovations and purchase essential inventory, Ms. Thomas turned to a predatory online lender for a $40,500 loan, leaving her with a blended interest rate of 58.2% and monthly payments of $4,400.

In 2019, Ngina consulted Wacif for help, and Wacif provided her a $35,000 term loan through the Entrepreneurs of Color Fund to pay off her company’s outstanding balance with the predatory lender. Since then, Ngina’s monthly payments have drastically reduced to just over $1,000, with an interest rate of 7.75%. Ngina’s loan allowed her to increase inventory and introduce new lines of service, both major sources of revenue for Studio Chique.

Supported by

Brothers Giuseppe and Mario Lanzone immigrated to the United States from Peru over two decades ago. After being apart for several years, the brothers finally reunited and decided to start a business that showcased their native cuisine. In 2013, they opened their first food truck dedicated to serving Peruvian food inspired by Andean, Spanish, African, and Asian flavors.

Several food trucks later, the brothers decided to take a leap of faith and open their first brick-and-mortar restaurant. With help from the Latino Economic Development Center (LEDC), the brothers secured a small business loan, funded by the Entrepreneurs of Color Fund, which allowed them to realize their dream.

In early 2020, Peruvian Brothers officially opened inside La Cosecha, a Latin American food market in Northeast DC. Since opening their first brick-and-mortar restaurant, the brothers have gone on to open a new location in Arlington, Virginia.

Supported by

"LEDC was more than a lender. They were family of resourceful teammates that have been helping us stay ahead, even during a crazy year, even in the increasingly competitive restaurant business."

"I have been working with WACIF for several years now. The capital funding has been crucial to the success we are now seeing."

Manuel “Manny” Cosme founded CFO Services Group in 2012 to provide a critical service that was missing: accounting beyond tax work for small businesses and non-profits. CFO Services Group and Wacif have worked together since 2013 to collectively serve local entrepreneurs. To further support entrepreneurs, CFO Services Group used funding from the Entrepreneurs of Color Fund to retain a full-time business development associate in 2019, leading to the creation of six jobs.

In 2020, CFO Services provided even more critical services to help small businesses and non-profits adapt to the challenges brought on by the COVID-19 pandemic. From education on financial assistance programs to leading “disaster planning” strategy sessions with businesses, CFO Services Group has helped entrepreneurs and leaders pivot and plan their way through this challenging economic time.

Supported by

Dr. Charlayne Hayling-Williams and Dr. Rod Williams founded Community Wellness Ventures in Ward 8 to address the systematic barriers and lack of results-based accountability infrastructure, with the goal of reducing health disparities by meeting the comprehensive needs of the individuals served.

With over 40 years of combined experience in the areas of mental health, disability, affordable housing, and community development, Dr. Williams and Dr. Hayling-Williams, along with their team of behavioral health practitioners, provide the highest level of person-centered care by meeting the comprehensive needs of their clients. Through the Entrepreneurs of Color Fund, Community Wellness Ventures received a loan to support debt satisfaction, new hire related expense, software upgrades, and office relocation assistance.

While the COVID-19 pandemic has reduced foot traffic to the business, Community Wellness Ventures remains optimistic about the future and continues to support clients via telemedicine and limited in-person appointments.

Supported by

"We believe that health and wellness may only be fully understood in the context of one’s comprehensive needs being met… as they define them."

To start a conversation about supporting inclusive

entrepreneurship and community wealth-building by

investing in the Fund, please email

Melissa Stallings

mstallings@capitalimpact.org.

PARTNERS

FUNDERS

COPYRIGHT © 2022 | Washington, D.C. Entrepreneurs of Color Fund